About National General Car Insurance

National General, acquired by Allstate in 2021, specializes in nonstandard coverage, including auto, homeowners, renters, and umbrella insurance policies. Notable features include a $500 emergency expense allowance for covered claims and the ability to file SR-22 forms for drivers with certain convictions.

Pros:

- $500 emergency expense allowance for covered claims.

- Will file SR-22 forms if needed, accommodating drivers with a DUI conviction.

- Offers policies to drivers with high-risk profiles.

Cons:

- Higher-than-average premiums, especially for high-risk drivers.

- Doesn’t appear to provide gap coverage.

Key Points:

- Emergency Expense Allowance: National General stands out for its $500 emergency expense allowance, covering costs like food, lodging, or travel after a covered claim, ensuring you’re not stranded post-accident.

- Customer Satisfaction: The company ranks below average in customer satisfaction, placing 19th out of 21 insurance companies in the 2022 J.D. Power U.S. Claims Auto Satisfaction Study.

- SR-22 Coverage: National General caters to drivers needing SR-22 forms due to DUI convictions or multiple infractions, offering coverage options for first-time DUI offenders.

- Premiums: Specializing in the nonstandard car insurance market, National General tends to have higher premiums than the national average, making it more suitable for high-risk drivers or those facing challenges securing coverage.

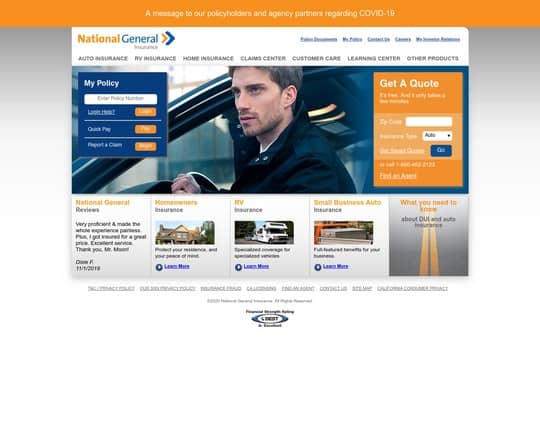

- Claims Handling: Claims can be submitted online or over the phone, with minor claims processed within 48 hours. The company offers typical auto coverage, including bodily injury liability, property damage liability, collision, comprehensive, and more.

- Discount Programs: National General provides standard discount programs such as multipolicy, low mileage, multivehicle, safe driver, and paperless discounts. Repairs at partner Gold Medal Repair Shops come with a lifetime guarantee.

- Telematics: The telematics program, DynamicDrive, tracks driving habits through an app, potentially offering savings. However, it’s not available in all states.

Is National General Right for You?

National General may be a suitable choice if you’re a new driver, have a less-than-ideal credit history, or face challenges due to driving infractions. However, premiums are generally higher, so drivers with clean records may find more affordable options elsewhere.

Getting a Quote

To obtain a policy, you need to work with an independent agent from National General’s extensive network. Factors like age, location, driving record, vehicle details, and credit (where applicable) impact rates. It’s advisable to request quotes from multiple insurers to compare.

Consider Alternatives

If unsure about National General, alternatives like Geico and Progressive offer competitive rates, various discount programs, and better customer satisfaction ratings.

In conclusion, National General is a viable option for high-risk drivers, but individuals with a clean record may find more cost-effective and customer-friendly choices.